The secret to submissions that get quoted (not declined)

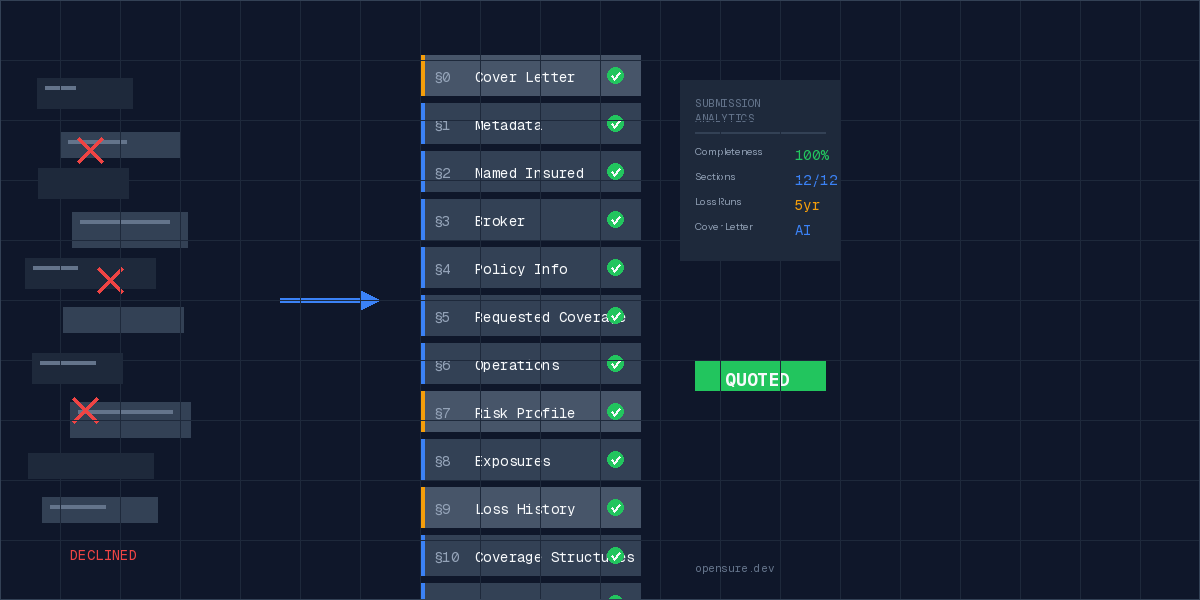

80% of submissions are incomplete or unstructured. Here's the 12-section format that makes underwriters say yes faster.

You've done the legwork. Found a tough risk. Identified three markets that might bite. Spent an hour assembling the submission.

Then silence.

Or worse—a one-liner: "Unable to quote. Incomplete information."

Here's what nobody tells you: most submissions get declined before an underwriter even reads them.

Not because the risk is bad. Because the submission is.

Why 80% of Submissions Fail Before They Start

Talk to any wholesaler. They'll tell you the same thing:

- Incomplete apps — blank fields, missing pages, outdated forms

- No cover letter — underwriters have no context, no story, no reason to care

- Loss runs missing — or worse, only 3 years instead of 5

- No operations narrative — just a NAICS code and a prayer

- Disorganized attachments — 17 PDFs with names like "scan001.pdf"

The submission sits in a queue. The underwriter opens it, scans for red flags, and moves on.

Your risk never stood a chance.

What a Winning Submission Actually Looks Like

The Independent Insurance Agents & Brokers of America (Big-I) has been preaching this for years. A "winning submission" isn't just complete—it's structured to tell a story.

Here's what separates quotes from declines:

❌ Typical Submission

- ACORD app (half-filled)

- 3 years of loss runs

- Random attachments

- No cover letter

- No narrative

✅ Winning Submission

- Professional cover letter

- Complete ACORD app

- Operations narrative

- Management & safety culture

- 5-year loss runs with analysis

- Organized document checklist

The difference? One makes the underwriter work. The other makes it easy to say yes.

The 12-Section Structure That Gets Results

We studied what top producers do differently. Then we built a submission format around it.

Every Opensure submission follows a 12-section structure:

- Cover Letter — AI-generated executive summary that sells the account

- Submission Metadata — version, date, lines requested

- Named Insured — complete business profile with NAICS, entity type, revenue

- Producing Broker — your contact info, agency code, office details

- Policy Information — effective dates, target premium, current carriers

- Requested Coverage — limits, deductibles, rating basis for each line

- Operations Summary — what they do, where they work, revenue breakdown

- Risk Profile — management experience, safety culture, controls

- Exposure Schedules — property, GL, and auto in clean tables

- Loss History — 5-year summary with large loss analysis

- Coverage Structures — current vs. requested, target outcome

- Attachments — organized checklist with labels A, B, C...

That's 15-30 pages of professional, structured documentation. The kind that makes underwriters take you seriously.

The Cover Letter Changes Everything

Here's the part most brokers skip—and it's the most important.

A great cover letter does three things:

- Introduces the risk — who they are, what they do, why they're worth quoting

- Highlights the positives — dedicated risk manager, clean loss history, carrier loyalty

- Explains the marketing reason — prior carrier exited, pricing, expansion

It's not fluff. It's context.

Underwriters are busy. They're scanning 50 submissions a day. A cover letter tells them: "This one's worth your time."

Opensure generates this cover letter automatically. You fill in the data—the AI writes the narrative.

The Key Differentiator

Here's the real secret:

Every submission you send is structured to make underwriters say yes faster.

Not because you spent hours formatting. Because the structure is built in.

- Fields are validated before you send

- Loss runs are summarized with totals and trends

- Operations narratives are generated from your data

- Attachments are organized and labeled automatically

The underwriter opens your submission and sees exactly what they need. In the order they expect it. With the context that makes them confident to quote.

No more "incomplete information." No more silence.

What This Looks Like in Practice

Picture this:

You're marketing a contractor account. Prior carrier exited the class. You've got 48 hours to find capacity.

Old way: Pull together ACORD apps, hunt for loss runs, paste everything into an email, hope for the best.

New way: Opensure scrapes the intake data, matches the risk to markets, generates a 20-page submission package with a professional cover letter, and delivers it to three wholesalers. All before lunch.

Same risk. Different outcome.

Stop Sending Submissions That Get Ignored

The insurance industry runs on relationships. But relationships don't matter if your submission never gets read.

Structure matters. Completeness matters. Presentation matters.

Opensure handles all three—automatically.

The 12-section submission structure is based on Big-I best practices and ACORD-125 standards. Opensure's AI-powered submission writer is currently in development—join the waitlist to be first in line.